Dental, Visions, Hearing Popular By Choice

Stand-alone dental plans are a big hit for people who are:

• Self-employed gig workers

• On ACA Marketplace healthcare plans

• On Original Medicare

• On MediGap plans

• On employer insurance that doesn't cover DVH

• Or for those that are wanting to go to a particular dentist that their Medicare Advantage plan does not contract with.

Get help to Pay

Original Medicare and ACA Marketplace plans have very limited coverage for Dental, Vision, and Hearing.

Dental/Vision/Hearing Insurance

Dental Coverage

Does Medicare cover my dental procedures?

Original Medicare (Part A and Part B) has very limited dental coverage that is only meant to protect your general health in order for another Medicare-covered health service to go smoothly. It does not cover checkups, cleanings, fillings, dentures (full or partial), or most tooth extractions. Medicare Supplements (MediGap) also will not cover these additional benefits.

However, many Medicare Advantage plans will include additional dental benefits as part of their network-based plans. Some clients who have Medicare Advantage plan with dental, vision and hearing will still purchase a stand-alone DVH plan because they want to have a wider network of dentists, or, their favorite dentist does not take Medicare Advantage.

Does the ACA Marketplace healthcare for people under age 65 cover Dental?

Many ACA Marketplace plans offer limited or no coverage for DVH unless it's a pediatric requirement. For the non-pediatric benefits, the dental is only preventative in nature. Preventative means cleaning and X-rays. It does not include extractions, fillings, root canals, etc.

Vision Coverage

Does Original Medicare provide vision coverage?

In most cases, Original Medicare does not include coverage for routine eye exams, eyeglasses, or contact lenses.

Normally Medicare will pay only if following cataract surgery that implants an intraocular lens. Following that specific surgery, Medicare Part B will help pay for corrective lenses, one pair of eyeglasses or one set of contact lenses provided by an ophthalmologist.

However, the drawback is it will only offer this benefit once per lifetime and they only pay for a standard pair of eyeglasses. You would be responsible for the cost of upgraded frames.

Part B also covers a glaucoma screening every 12 months but only for people at high risk for it. This includes those with diabetes, people with a family history of glaucoma, African Americans who are 50 or older, and Hispanic Americans who are 65 and older.

Part B will cover certain diagnostic tests and treatment of diseases and conditions of the eye.

If you are wanting routine eye exams and more than one pair of eyeglasses or contact lenses (or better than the standard frames) then finding a stand-alone DVH plan or one where vision benefits are included will be required.

Does the ACA Marketplace provide vision coverage for people under age 65?

Many ACA Marketplace plans offer limited or no coverage for Vision unless it's a pediatric requirement or the eye treatment is based on a medical need and not for a routine eye exam. An example of this would be a face injury from an accident that involved the eyes.

Hearing Coverage

Does Original Medicare provide vision coverage?

If you only have Original Medicare, it does not cover hearing aids. Part B does cover some hearing tests, such as diagnostic hearing and balance exams. You will have to go through your primary care provider for your intitial screenings. Once they recommend that you need additional treatment, your Part B coverage will pay for a portion of the costs.

Ultimately what we have found works best is for our clients to enroll in a stand alone DVH plan that combines the dental, vision and hearing benefits. The monthly premium is how and allows you to have more coverage than what you would normally be provided otherwise with just Original Medicare.

Summary

What works best?

Whether you are on Medicare or you are under 65 on an ACA plan, ultimately what we have found works best is for our clients to enroll in a stand alone DVH plan that combines the dental, vision and hearing benefits. The monthly premium is low and allows you to have more coverage than what you would normally be provided otherwise with just Original Medicare or an ACA plan.

Standalone Dental, Vision, and Hearing (DVH) plans can be a great supplement—especially for people on ACA Marketplace plans or Original Medicare, both of which often leave gaps in these areas. Here's what's great about them:

-

Fills Major Coverage Gaps

Original Medicare (Part A & B) does not cover routine dental, vision, or hearing. Many ACA Marketplace plans offer limited or no coverage for DVH unless it's a pediatric requirement.

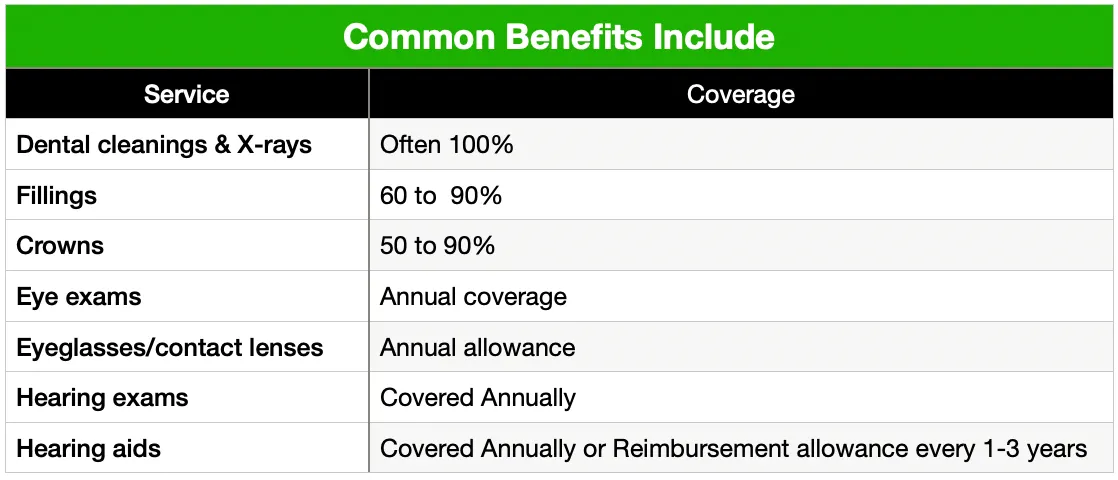

👉 DVH plans provide access to preventive and restorative dental, eye exams, glasses, hearing tests, and hearing aids.

-

Affordable Monthly Premiums

Plans are typically affordable and depend on age and benefits. Cost-effective for routine care (like cleanings, exams, glasses, etc.) and major needs like crowns or hearing aids.

-

No Need to Change Medical Insurance

These plans are standalone—you can keep your ACA or Medicare plan and just add DVH for extra protection. No conflict with existing insurance coverage.

-

Often Guaranteed Issue

Many DVH plans are guaranteed acceptance (no underwriting or medical questions). This is especially useful for seniors or those with pre-existing conditions.

-

Useful for Retirees and Self-Employed Individuals

People without employer coverage often lose DVH benefits. Standalone plans restore access to routine and emergency care without high out-of-pocket surprises.

-

Freedom to Choose Providers

Many DVH plans use national networks. Some plans even allow out-of-network usage with partial reimbursement.

Our 3 Step Process

Expert Consultation

Our expertise is free of charge as we guide you through the options that suit you the best based on your circumstances.

Discover & Strategy

With a few simple questions, we can help determine where you are financially exposed or if the plan you have is the right fit for your situation.

Facilitating the Process

We pride ourselves in simplifying the process from start to finish. After enrollment into your plan, we are available to you anytime you need us.

Our Approach

Depending on where you live, we offer consultations by phone or in-person. We also offer video consultation if you prefer to have the best of both worlds.

We do not offer every plan available in your area. Currently, we represent 14 organizations which offer 137 products in your area. Please contact Medicare.gov, 1-800-Medicare, or your local State Health Insurance Program (SHIP) to get information on all of your options.

© 2020 Help You Insurance, Inc., All Rights Reserved.