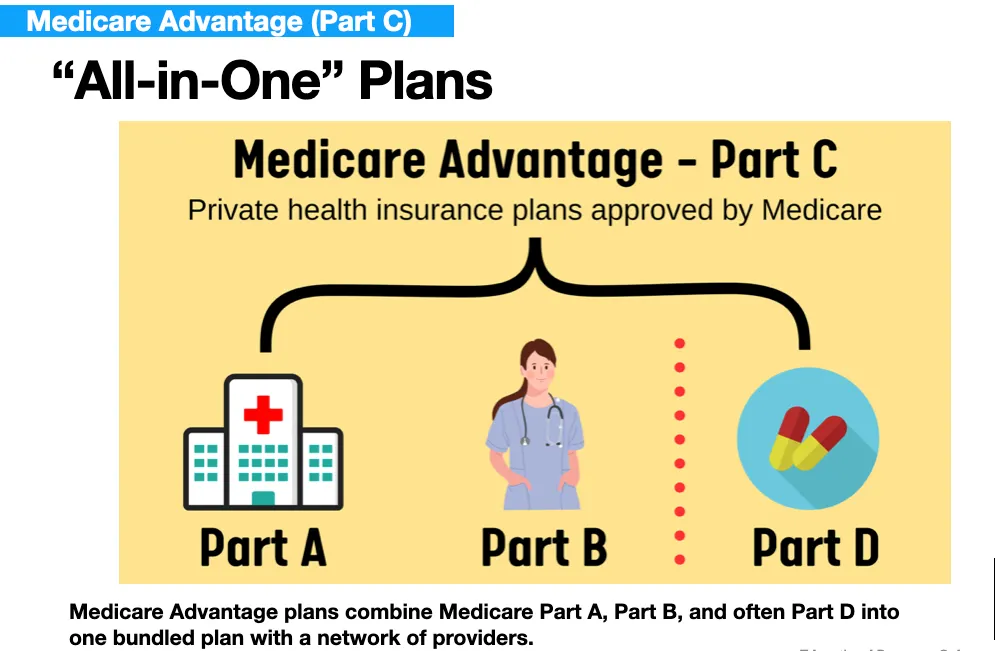

Medicare Advantage bundled plans

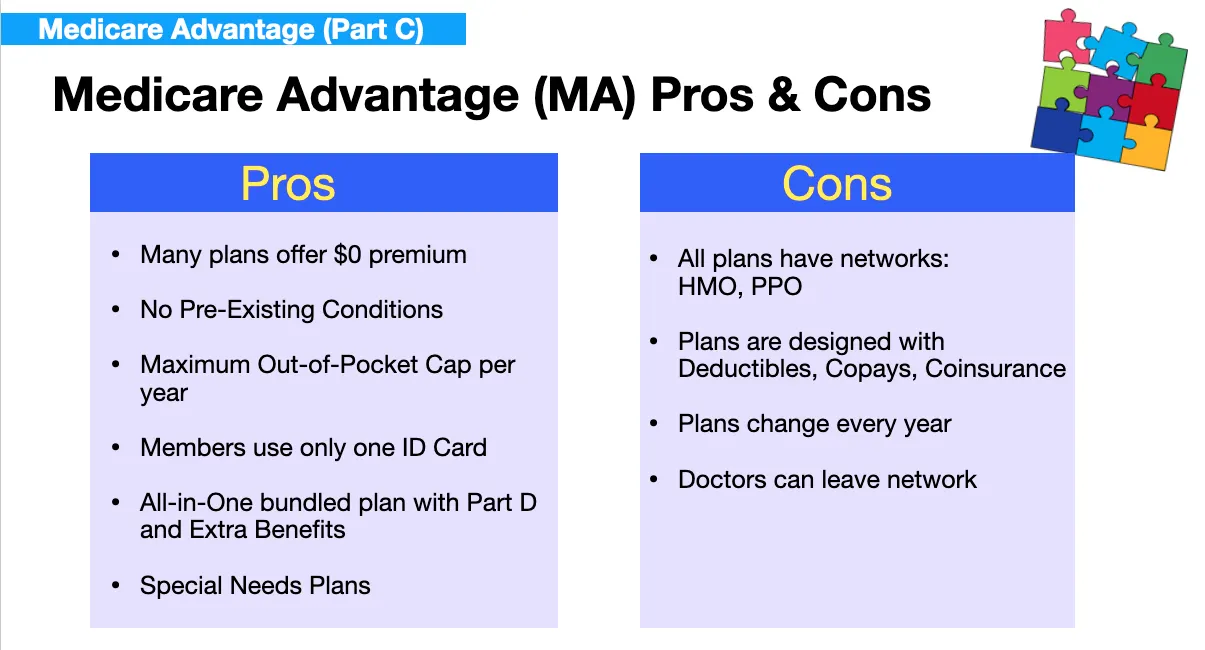

Medicare Part C is also called, "Medicare Advantage". They are bundled plans that often include prescription drug coverage along with other extra benefits. They are network plans such as HMO's and PPO's with copayments and coinsurance as services are rendered.

Photo by Online Marketing on Unsplash

Get help to Pay

At least 85% of Medicare Advantage plans have ZERO COST monthly premiums.

Medicare Advantage Insurance

Medicare Advantage Coverage

What does Medicare Advantage cover?

Medicare Advantage, also known as Medicare Part C, are plans run by private insurance companies with the help from subsidies provided by the government so that the insurance company can design network-based plans at a low or zero premium. These networks called HMOs and PPOs.

These plans are an alternative to Original Medicare and are normally designed with copays and coinsurance as you use the plan services as a form of cost share tht the client would assume when joining one of these plans.

They are all-in-one, "bundled plans" that include:

-

Medicare Part A & Part B. (Our Federal Government subsidizes the private company to run Medicare Part A & Part B for them.)

-

Prescription Drugs: some have an option to drop the prescription drug part of the plan. For instance, you may be a Vet getting your drugs from the VA, instead

-

Dental, Vision, and Hearing

-

Special Needs Plans for people with Chronic Illness or those eligible or on Medicaid.

-

Plus, other benefits like gym membership, over-the-counter money, etc.

-

Note: some may even offer a "Give Back" benefit where they pay some of your monthly Medicare Part B premium.

How much to Medicare Advantage plans cost?

Many Medicare Advantage plans offer $0 premium per month. How can they do this? Our Federal Government subsidizes these companies to run Medicare Part A & Part B for them, so that they don't have to. For each member who signs up for a Medicare Advantage plan, our government gives a monthly subsidy. The subsidy is substantial enough that the insurance companies can offer these plans at a ZERO monthly rate. Cost will vary with plan type from county to county. The best thing to do is schedule a consultation with us so that we can review which plans are available in your areas and determine if the plans available would offer you additional benefits such as dental, vision, and hearing benefits. You can press the "Click to Call" button above to reach us today!

So, then do I have to pay for anything else?

Yes. You may have to pay a medical deductible and a drug deductible depending on the plan. You also have to pay for copays and coinsurance each time you get a service, depending on your service. There is a cap or "stop loss" on how much you pay out of your pocket each year, however. This is called a MOOP or Maximum Out of Pocket.

IMPORTANT NOTE:

Medicare Part B is a separate payment from Medicare Advantage, even though the Medicare Advantage plan has Part B bundled inside it. So, you are still responsible for making your Part B monthly premium each month. In 2024, that amount is $174.70 per month. If you are getting your Social Security Benefit each month, the amount will be automatically deducted from your Benefit. You do not have to worry about physcially making that monthly payment

Just to reiterate . . .

If you have a Medicare Advantage plan then this becomes your Primary insurance and Original Medicare gets set aside but you will still need to continue paying your Medicare Part B monthly premium.

Our 3 Step Process

Expert Consultation

Our expertise is free of charge as we guide you through the options that suit you the best based on your circumstances.

Discover & Strategy

With a few simple questions, we can help determine where you are financially exposed or if the plan you have is the right fit for your situation.

Facilitating the Process

We pride ourselves in simplifying the process from start to finish. After enrollment into your plan, we are available to you anytime you need us.

Our Approach

Depending on where you live, we offer consultations by phone or in-person. We also offer video consultation if you prefer to have the best of both worlds.

We do not offer every plan available in your area. Currently, we represent 14 organizations which offer 137 products in your area. Please contact Medicare.gov, 1-800-Medicare, or your local State Health Insurance Program (SHIP) to get information on all of your options.

© 2020 Help You Insurance, Inc., All Rights Reserved.