Medicare Supplement "MediGap" freedom to choose

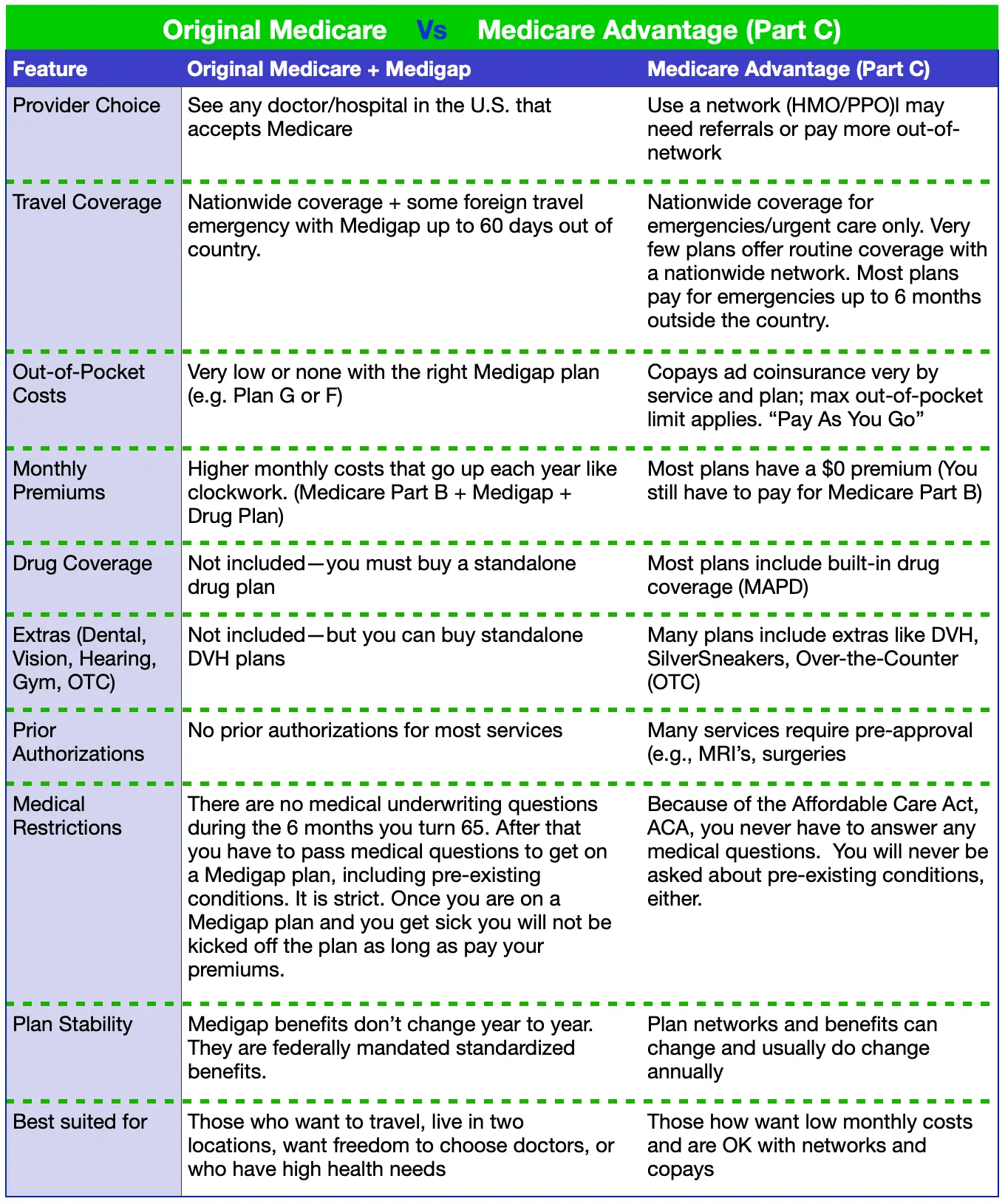

Original Medicare only covers 80% of your Part B medical expenses. The other 20% comes out of your pocket if you do NOT have a Medicare Supplement policy, also referred to as MediGap. If you were to have a lengthy stay in a hospital or expensive treatment at an outpatient facility, you can see how that could add up. Medicare Supplements pay that 20% for you. The 2nd reason people want a Medicare Supplement is the freedom it gives you to see any doctor that accepts Medicare, which is about 96% of all doctors nationwide!

Get help to Pay

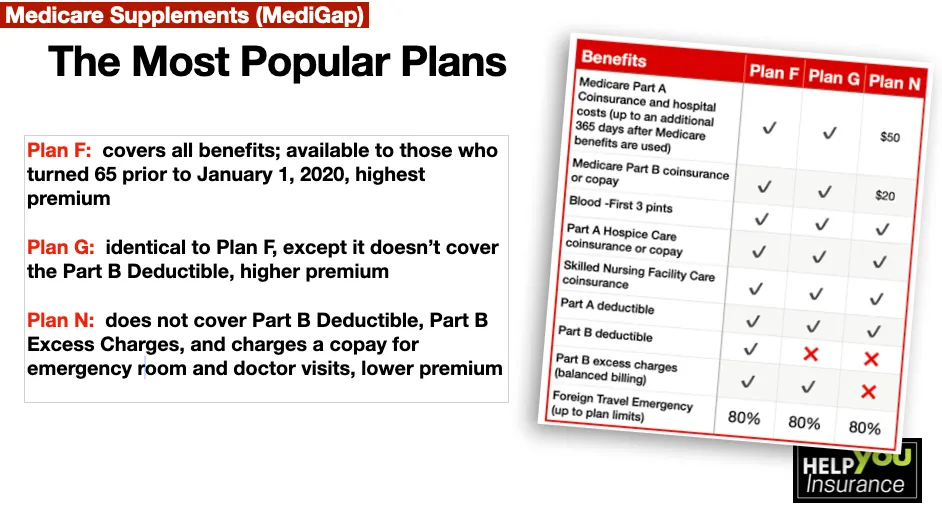

Medicare Supplement Plan G and Plan N are the most popular nationwide.

Medicare Supplement "MediGap" Insurance

Medicare Supplement Coverage

What is a Medicare Supplement plan?

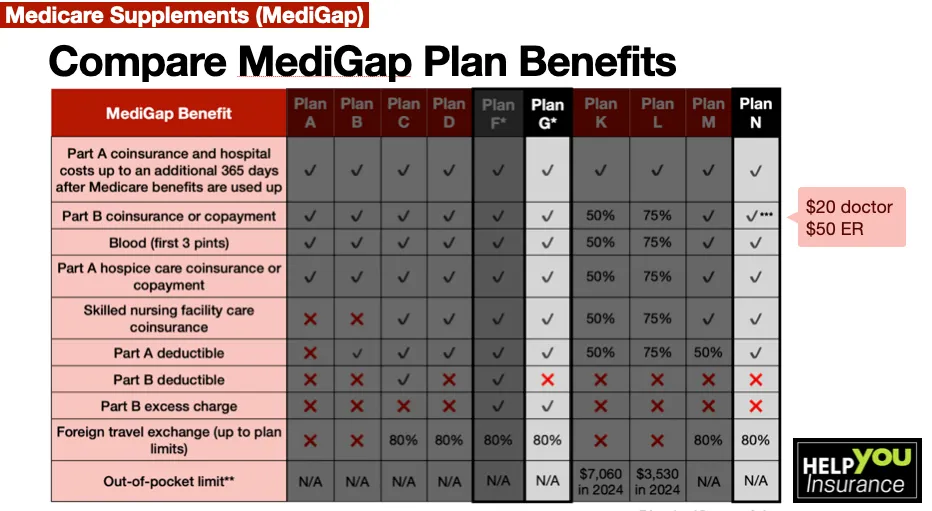

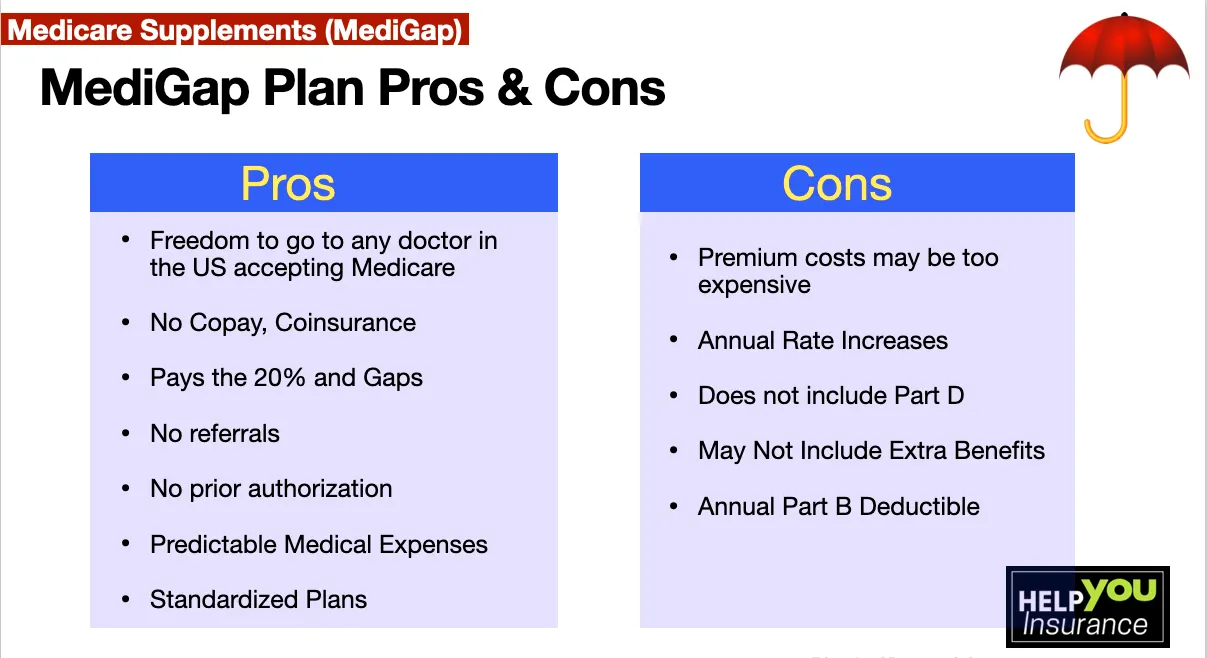

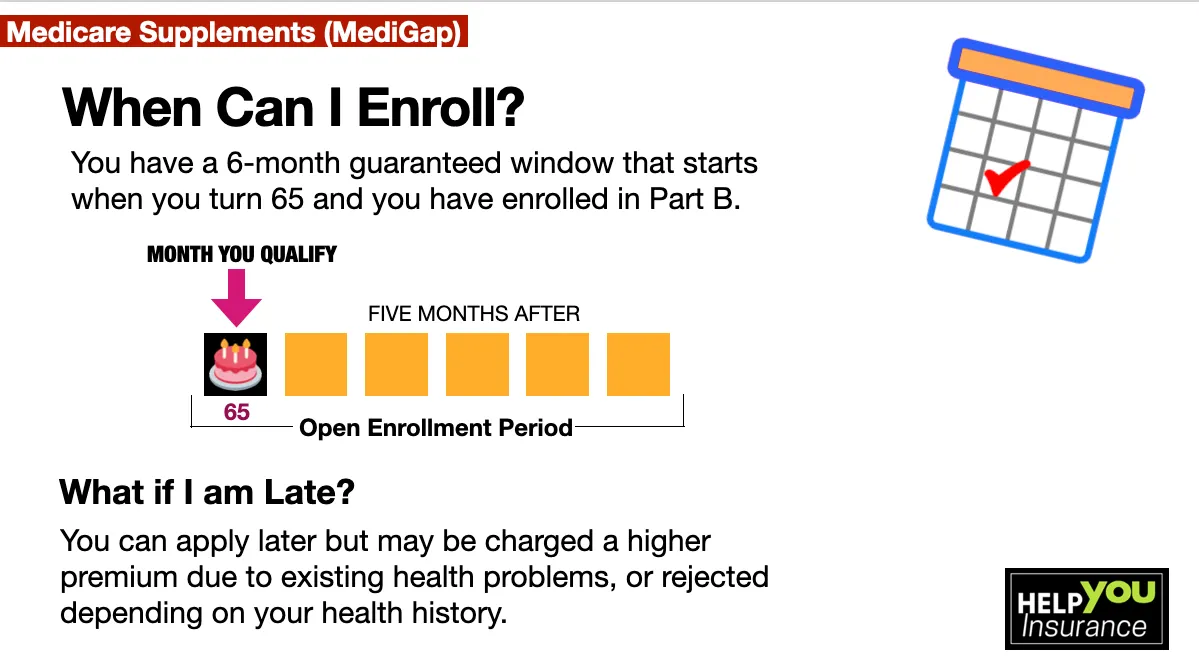

Medicare Supplements, also known as "MediGap" policies, are sold by private insurance companies to help you cover the out-of-pocket costs left behind by Medicare. They are federally standardized plans, meaning all the plans offer same benefit structure. (Notice the benefits listed on the chart below.) So, a Plan A has the same benefit structure as a Plan N. The only change that happens in these standardized plans is their rates that change every year. Their rates are called "monthly premiums". The most popular plans are Plan G and Plan N. Plan F is popular for those turning 65 prior to January 1, 2020.

When you have a MediGap policy, Original Medicare pays up to its limit on your medical expenses. Then, your MediGap plan kicks in to help cover the costs up to the plan limit. That limit usually covers what Medicare didn't, however, that will depend on the policy you select.

What do Medicare Supplements cover?

Original Medicare only covers 80% of your Part B expenses. (Remember, those are your outpatient medical expenses.) The other 20% comes out of your pocket if you do not have a Medicare Supplement policy, also referred to as MediGap. If you were to have a lengthy stay in a hospital for expensive treatments a an outpatient facilities, you can see how that could add up.

Medicare Supplements pay that 20% for you.

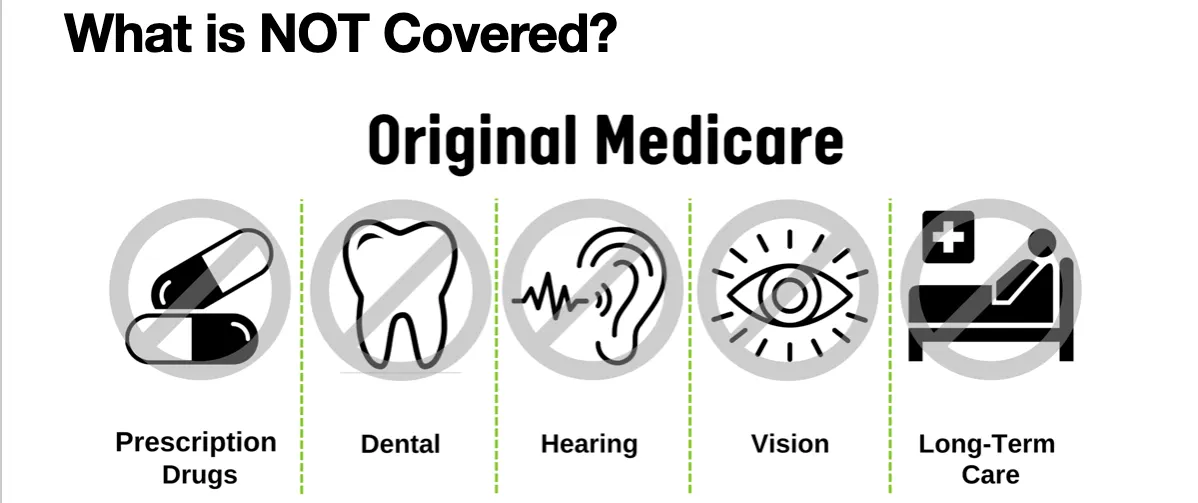

Is there anything benefit that is NOT covered by Medicare Supplement plans?

Benefits that are not covered by Original Medicare will not be covered by a Medicare Supplement, either.

Which Plan?

Which MediGap plans can I choose from?

The three most popular plans are: Plan G, Plan N, and Plan F

Plan F: Because it essentially covers everything Plan F is often the most expensive Medigap plan, with premiums higher than Plan G or N. Also, it is only available if you were eligible for Medicare before Jan 1, 2020.

Plan G and N: make you pay an annual Part B deductible of $257 in 2025. This means your first doctors visit will ask you to pay this amount out-of-pocket. After that deductible is met, you will ZERO out of your pocket in the form of deductibles, copays or coinsurance for the rest of the year.

Plan G: is identical to Plan F except it makes you pay for the Annual Part B deductible. Covers all the benefits stated in the benefit structure, including Balanced Billing. Let's see this in action: You go to the Mayo Clinic. The Mayo Clinic is allowed to charge you up to 15% over what Medicare agrees to pay. However, you would NOT have to pay for the 15% out of your pocket because. you have a Plan G.

Plan N: You would have to pay that extra 15% excess charge if you have a Plan N, as it will NOT cover balanced billing.

Plan N: Because Plan N charges a lower monthly premium than a Plan G, it charges a minimal copay of $20 to see a doctor or specialist and it charges $50 for a hospital visit throughout the year.

Plan G: Does not charge Copays after deductible is met.

Our 3 Step Process

Expert Consultation

Our expertise is free of charge as we guide you through the options that suit you the best based on your circumstances.

Discover & Strategy

With a few simple questions, we can help determine where you are financially exposed or if the plan you have is the right fit for your situation.

Facilitating the Process

We pride ourselves in simplifying the process from start to finish. After enrollment into your plan, we are available to you anytime you need us.

Our Approach

Depending on where you live, we offer consultations by phone or in-person. We also offer video consultation if you prefer to have the best of both worlds.

We do not offer every plan available in your area. Currently, we represent 14 organizations which offer 137 products in your area. Please contact Medicare.gov, 1-800-Medicare, or your local State Health Insurance Program (SHIP) to get information on all of your options.

© 2020 Help You Insurance, Inc., All Rights Reserved.