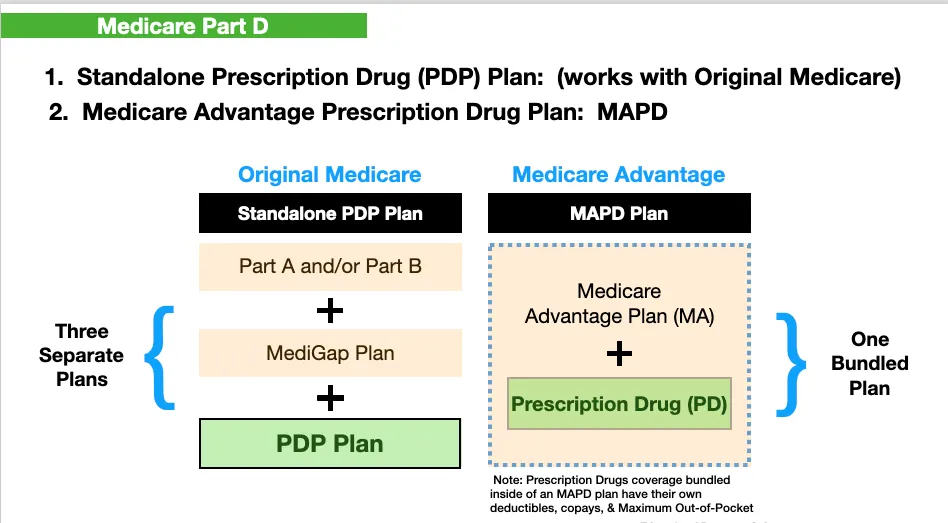

Prescription Drugs bundled or standalone

Prescription drug plans (PDP) can either be a stand-alone plan for people who are on Original Medicare or a Medicare Supplement (MediGap) plan or inside of a Medicare Advantage plan. Either way, they generally follow the same benefit structure:

• 3 stages of pricing

• a maximum-out-of-pocket that is separate from your medical plan

• formularies and tiers

Photo by little plant on Unsplash

Get help to Pay

Even healthy people should consider a basic prescription drug plan to avoid penalties and have protection in case a condition arises unexpectedly.

Prescription Drug Insurance

Drug Coverage

What does a Prescription Drug Plan (PDP) cover?

They are run by privately held companies and all plans have to have:

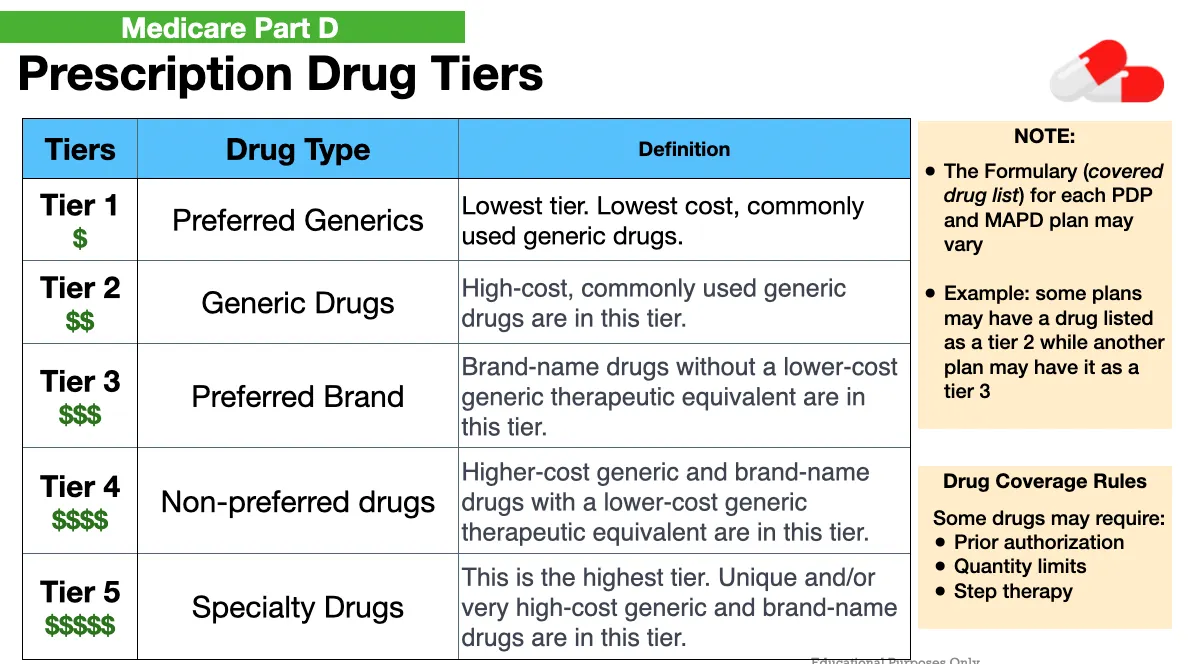

• Formularies: These are a list of covered drugs Tiers: Covered drugs are grouped into different cost-sharing levels within the formulary. All Drug Plans: All plans cover at least 2 drugs in each category of drugs, so you are not left high and dry.

• Vaccines: All plans must cover all commercially available vaccines.

How do you get a PDP plan??

They are bundled inside a Medicare Advantage plan. They can be purchased as a "standalone" plan to accompany a MediGap plan, formerly called Medicare Supplement, along with your Original Medicare: Part A (Hospital) and Part B (Medical).

NOTE: You cannot enroll in a Medicare Advantage plan with a drug plan bundled in it AND enroll in a standalone drug plan at the same time. One will cancel out the other one.

How much do Drug Plans Cost?

Nationwide the average cost for a drug plan in 2025 is around $36 for the monthly premium.

Prices typically go up because the drug companies and insurance companies are incurring a higher cost burden due to the Inflation Reduction Act (IRA). Some drug companies are experiencing heavy utilization due to 'long Covid' which was unexpected and, for that reason, they have raised their rates.

Many believe Pharmacy Benefit Managers (PBMs) who are 'middlemen'/'middlewomen', and who dictate the rates, are part of the problem as they raise the costs that everyone pays down the supply chain. For instance, your neighborhood big chain drug stores are finding it much harder to keep their doors open. They are claiming to be "gouged" by the PBMs.

How has the Inflation Reduction Act (IRA) affected drug prices?

The IRA lowered the cost of insulin down to $35, and lowered catastrophic coverage from $8,000 down to $2,000 in 2025. In doing so they got rid of the infamous "Donut Hole" where a portion of our population paid a whopping 25% of the retail cost of their drugs.

Besides paying a monthly premium, some plans will charge a deductible, or at least a deductible on their more expensive Tiered drugs.

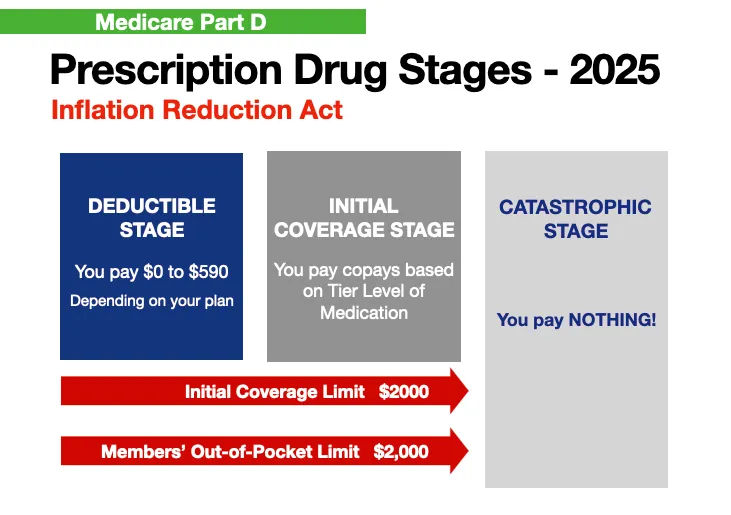

In 2025, there will be three stages of drug coverage:

Annual Deductible Stage: Your deductible may be different from the declared federal amount, or waived entirely. The deductible for 2025 is $590. You will pay discounted price for your medications until the deductible is met. Once the deductible is satisfied, you will begin the "Initial Coverage Stage". If there is a deductible, it is typically on Tiers 3, 4, and 5. Many plans do not have a deductible.

Initial Coverage Stage (Copay Stage): After your deductible is paid then you only share the cost based on your plan's formulary. Each prescription drug plan separates its medications into tiers. Each tier has a copay amount that you are responsible to pay. A Tier 1 drug may cost $0; a Tier 2 may cost you $5. It is typically separated by generic drugs versus brand name drugs and then, finally, specialized medications. In 2025, the Initial Coverage cap is $2,000. After you have paid this out of your pocket (sometimes in combination with your plan), then you will reach the Catastrophic stage.

Catastrophic Coverage: Once your out-of-pocket spending hits the $2,000 threshold, you enter the catastrophic coverage phase. In this stage, you pay $0 for covered Part D drugs for the remainder of the calendar year.

Summary

What plan works best?

We can provide you a quick quote to find the plan that will be best for you based on your circumstances. Remember, you never pay a dime for our services . . . ever! Just click on our phone number, or fill out the "Work with Us" box below.

Our 3 Step Process

Expert Consultation

Our expertise is free of charge as we guide you through the options that suit you the best based on your circumstances.

Discover & Strategy

With a few simple questions, we can help determine where you are financially exposed or if the plan you have is the right fit for your situation.

Facilitating the Process

We pride ourselves in simplifying the process from start to finish. After enrollment into your plan, we are available to you anytime you need us.

Our Approach

Depending on where you live, we offer consultations by phone or in-person. We also offer video consultation if you prefer to have the best of both worlds.

We do not offer every plan available in your area. Currently, we represent 14 organizations which offer 137 products in your area. Please contact Medicare.gov, 1-800-Medicare, or your local State Health Insurance Program (SHIP) to get information on all of your options.

© 2020 Help You Insurance, Inc., All Rights Reserved.