Under 65 Health Insurance ACA Marketplace

The Affordable Care Act (ACA)

The Marketplace provides individuals, families, and small businesses the ability to shop, compare, and purchase comprehensive healthcare insurance coverage. You cannot be denied coverage due to pre-existing conditions. ACA plans consist of Bronze, Silver, Gold, and Platinum plans.

Get help to Pay

Many people qualify for subsidies which can significantly reduce the monthly premiums clients pay for coverage.

ACA Marketplace Health Insurance

What was commonly known as "The Family Glitch" was fixed in 2023. What this means is dependents may now qualify for ACA premium subsidies even if the employee or their spouse have healthcare coverage from an employer. Qualifying for subsidies means you may be eligible for cost savings on your monthly premiums, making your insurance plan more affordable.

We are expert licensed agents and can explain the plan options available to you in your area.

Consultations Will NOT Cost you anything.

It will NOT be included as a fee on your premiums. We want to help you find the healthcare plan that's right for you!

Is your Group Health insurance plan too expensive? Let us explain the changes that might affect you.

Is your Group Health insurance too expensive for your dependents? The Family Glitch has been fixed. This is a Big Deal!

Frequently Asked Questions

My group health insurance seems too expensive? Can I get an ACA plan instead?

Maybe you've considered getting an ACA Marketplace insurance plan in the past for you and your dependents and thought you just could not afford the premiums. The American Rescue Act have increased the affordability of numerous plans for more individuals and families. We can help you figure out if you qualify for a subsidy. Even if you don't qualify for a subsidy, the ACA plan may be less expensive than their group plan. Give us a call!

Is my group health plan too expensive for my dependents?

In the past, "The Family Glitch" prevented many employees from getting affordable health insurance coverage for their dependents. If an employer provided affordable insurance to an employee, they did not have to extend affordable health insurance coverage to the dependents. The high cost of employer dependent coverage made it difficult to get affordable coverage for dependents. If an employee chose to get insurance for their dependents on the ACA Marketplace, the dependents would NOT qualify for an premium subsidies. This situation which impacted many families was commonly known as "The Family Glitch". "The Family Glitch" was fixed in 2023. Now, employee dependents can get a subsidy if they financially qualify. This is a BIG DEAL!

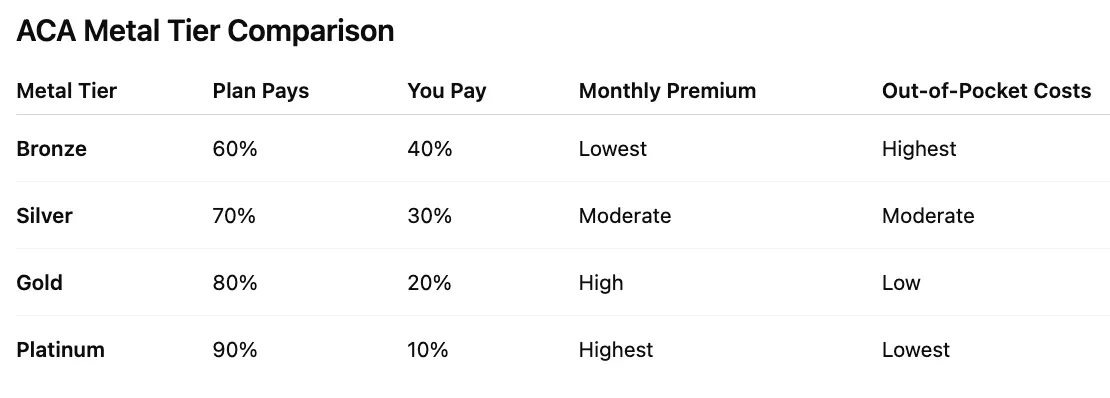

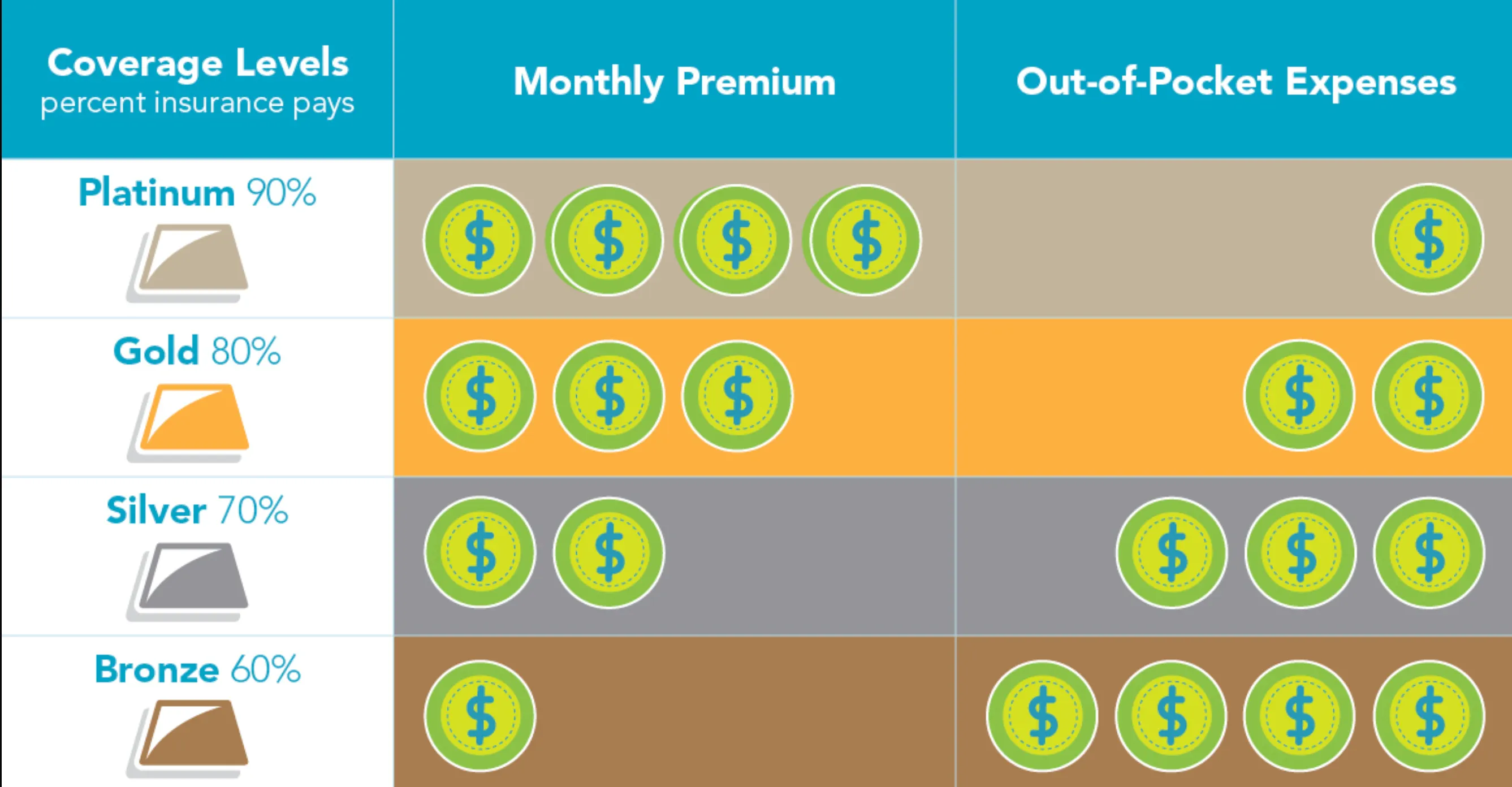

Can you give me key insights about the metal tiers in ACA?

• Bronze Plans: Ideal for individuals who are generally healthy and seek lower monthly premiums. However, they come with higher out-of-pocket costs when care is needed.

• Silver Plans: Offer a balance between premiums and out-of-pocket costs. Notably, if you qualify for cost-sharing reductions (based on income), these reductions are only available on Silver plans, effectively lowering your out-of-pocket expenses.

• Gold Plans: Suitable for those who anticipate frequent medical care, as they have higher premiums but lower costs when accessing services.

• Platinum Plans: Many states do not offer Platinum plans, such as Arizona. Best for individuals who require extensive medical care and prefer higher premiums in exchange for minimal out-of-pocket costs.

How do the Metal Tiers work?

The Affordable Care Act (ACA) categorizes health insurance plans into four metal tiers-- Bronze, Silver, Gold, and Platinum. The levels are based on how costs are shared between you and your insurance provider. These tiers hep you compare plans by balancing monthly premiums with out-of-pocket expenses like deductibles, copayments, and coinsurance.

Do you have Pellentesque et eleifend enim?

Integer est nibh, finibus sed egestas eu, tempor in nisl. Pellentesque in tempus lacus, sed posuere quam. Sed accumsan vel dui ac aliquet.

What does Deductible mean?

It means that you have to pay full price for the service until the deductible is met. Once the deductible is met, then you share the cost with the insurance plan with either a copay or coinsurance.

What is a copay?

Once you have satisfied the deductible, then you will share the cost with your insurance plan. When you share the cost using a fixed dollar amount, that is called a "copay". For instance, when you see your doctor, the receptionist will open up the glass window and ask for, say, $40. That is a fixed amount versus a percentage of your bill.

What is coinsurance?

Coinsurance is a percentage of a bill you have to pay versus a fixed amount (copay). So, for instance, for durable medical equipment like an oxygen tank, the doctor's office or supplier will ask you to pay 20% of the bill.

Our 3 Step Process

Expert Consultation

Our expertise is free of charge as we guide you through the options that suit you the best based on your circumstances.

Discover & Strategy

With a few simple questions, we can help determine where you are financially exposed or if the plan you have is the right fit for your situation.

Facilitating the Process

We pride ourselves in simplifying the process from start to finish. After enrollment into your plan, we are available to you anytime you need us.

Our Approach

Depending on where you live, we offer consultations by phone or in-person. We also offer video consultation if you prefer to have the best of both worlds.

We do not offer every plan available in your area. Currently, we represent 14 organizations which offer 137 products in your area. Please contact Medicare.gov, 1-800-Medicare, or your local State Health Insurance Program (SHIP) to get information on all of your options.

© 2020 Help You Insurance, Inc., All Rights Reserved.